United Of Omaha Living Promise Brochure

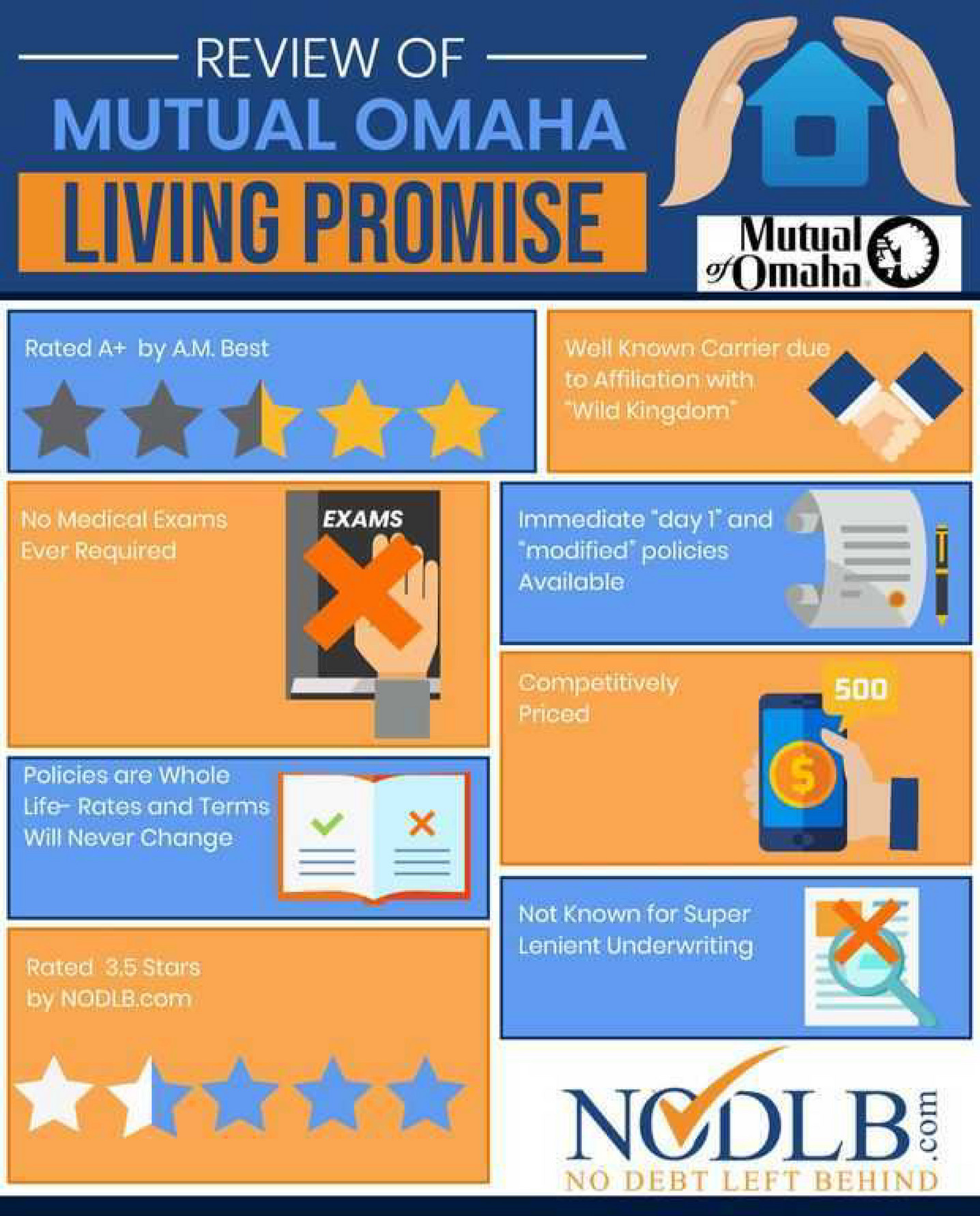

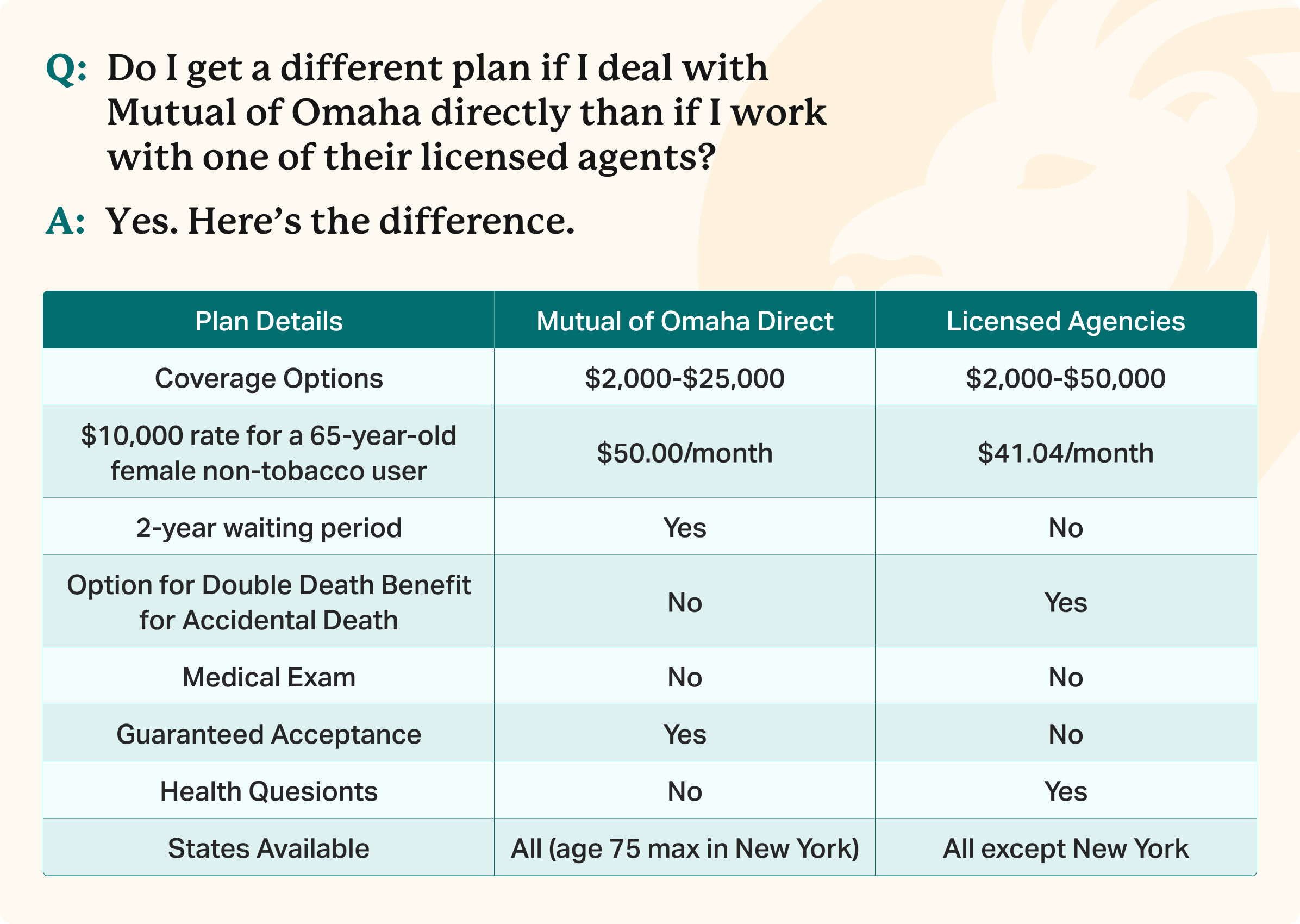

United Of Omaha Living Promise Brochure - Living promise provides two plans: A living promise whole life insurance policy from united of omaha life insurance company (united of omaha) pays benefits directly to the person of your choosing. Living promise whole life insurance. • no more than $20,000 of living promise graded benefit coverage • no more than $25,000 of all graded benefit coverage with united of omaha Living promise whole life insurance is one way for you to help protect loved ones during a difficult time. Funds may be used for final expenses and other purposes. A living promise whole life insurance policy from united of omaha life insurance company (united of omaha) pays benefits directly to the person you. Living promise provides two plans: Living promise is designed to help provide affordable protection that pays benefits directly to the person you choose to take care of your outstanding medical bills, unexpected expenses or. It can help take care. Depending on which plan you qualify for, you’ll have varying face amounts and premium options available. Living promise provides two plans: • no more than $20,000 of living promise graded benefit coverage • no more than $25,000 of all graded benefit coverage with united of omaha • no more than $40,000 of living promise level benefit coverage • no more than $50,000 of all. It can help take care of your final expenses,. At mutual of omaha, we offer living promise as your whole life insurance solution. Living promise whole life insurance level benefit plan: • no more than $20,000 of living promise graded benefit coverage • no more than $25,000 of all graded benefit coverage with united of omaha Living promise is designed to help provide affordable protection that pays benefits directly to the person you choose to take care of your outstanding medical bills, unexpected expenses or. It can help take care. • no more than $40,000 of living promise level benefit coverage • no more than $50,000 of all. United of omaha life insurance. At mutual of omaha, we offer living promise as your whole life insurance solution. Having a living promise whole life insurance policy in place may allow you to relax a little more because you know the planning. Annual premiums per $1,000 of coverage. Funds may be used for final expenses and other purposes. Living promise is designed to help provide affordable protection that pays benefits directly to the person you choose to take care of your outstanding medical bills, unexpected expenses or. Living promise provides two plans: • no more than $40,000 of living promise level benefit. Living promise whole life insurance is one way for you to help protect loved ones during a difficult time. It can help take care. Depending on which plan you qualify for, you’ll have varying face amounts and premium options available. Living promise | whole life insurance. • no more than $20,000 of living promise graded benefit coverage • no more. Living promise whole life insurance level benefit plan: • no more than $20,000 of living promise graded benefit coverage • no more than $25,000 of all graded benefit coverage with united of omaha Issue coverage with united of. Living promise provides two plans: Living promise whole life insurance. It can help take care of your final expenses,. Living promise whole life insurance level benefit plan: Living promise whole life insurance. Living promise provides two plans: Depending on which plan you qualify for, you’ll have varying face amounts and premium options available. Living promise provides two plans: Living promise whole life insurance level benefit plan: A living promise whole life insurance policy from united of omaha life insurance company (united of omaha) pays benefits directly to the person of your choosing. Living promise | whole life insurance. Annual premiums per $1,000 of coverage. Living promise | whole life insurance. A living promise whole life insurance policy from united of omaha life insurance company (united of omaha) pays benefits directly to the person you. • no more than $20,000 of living promise graded benefit coverage • no more than $25,000 of all graded benefit coverage with united of omaha Living promise build chart combined. At mutual of omaha, we offer living promise as your whole life insurance solution. Living promise whole life insurance. Funds may be used for final expenses and other purposes. Having a living promise whole life insurance policy in place may allow you to relax a little more because you know the planning is done. Living promise whole life insurance level. Living promise is designed to help provide affordable protection that pays benefits directly to the person you choose to take care of your outstanding medical bills, unexpected expenses or. It can help take care of your final expenses,. Living promise provides two plans: United of omaha life insurance. • no more than $20,000 of living promise graded benefit coverage •. At mutual of omaha, we offer living promise as your whole life insurance solution. • no more than $20,000 of living promise graded benefit coverage • no more than $25,000 of all graded benefit coverage with united of omaha Living promise whole life insurance. Living promise provides two plans: Issue coverage with united of. Living promise build chart combined maximum limits living promise level: Issue coverage with united of. Living promise whole life insurance. A living promise whole life insurance policy from united of omaha life insurance company (united of omaha) pays benefits directly to the person you. Living promise provides two plans: Living promise provides two plans: Having a living promise whole life insurance policy in place may allow you to relax a little more because you know the planning is done. Depending on which plan you qualify for, you’ll have varying face amounts and premium options available. Living promise whole life insurance level benefit plan: Funds may be used for final expenses and other purposes. Living promise whole life insurance level benefit plan: Living promise is designed to help provide affordable protection that pays benefits directly to the person you choose to take care of your outstanding medical bills, unexpected expenses or. A living promise whole life insurance policy from united of omaha life insurance company (united of omaha) pays benefits directly to the person of your choosing. Living promise whole life insurance is one way for you to help protect loved ones during a difficult time. Living promise provides two plans: • no more than $20,000 of living promise graded benefit coverage • no more than $25,000 of all graded benefit coverage with united of omahaMutual of Omaha Living Promise Whole Life Burial Insurance Review

Mutual of Omaha Your Insurance Group Agents

My publications Mutual of Omaha Living Promise Review Page 1

Mutual Of Omaha Guaranteed Issue Life Insurance Review

Mutual of Omaha Your Insurance Group Agents

Mutual of Omaha Living Promise A Comprehensive Guide by

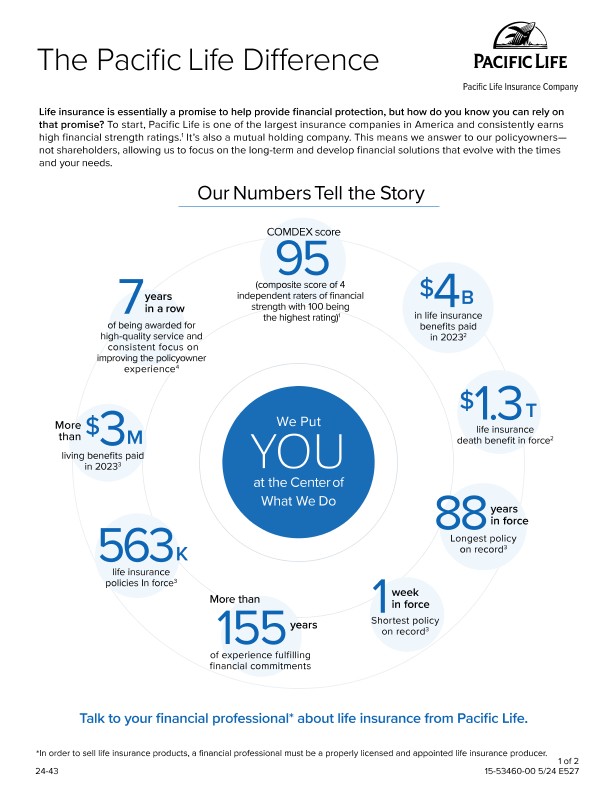

PL Promise Resources

Mutual Of Omaha Living Promise Brochure Pdf Brochure Resume

Mutual of Omaha Living Promise and IUL Express Oct 2023 YouTube

Mutual of Omaha Final Expense Insurance Review (2025)

It Can Help Take Care.

Annual Premiums Per $1,000 Of Coverage.

• No More Than $40,000 Of Living Promise Level Benefit Coverage • No More Than $50,000 Of All.

It Can Help Take Care Of Your Final Expenses,.

Related Post: