Trs Service Credit Brochure

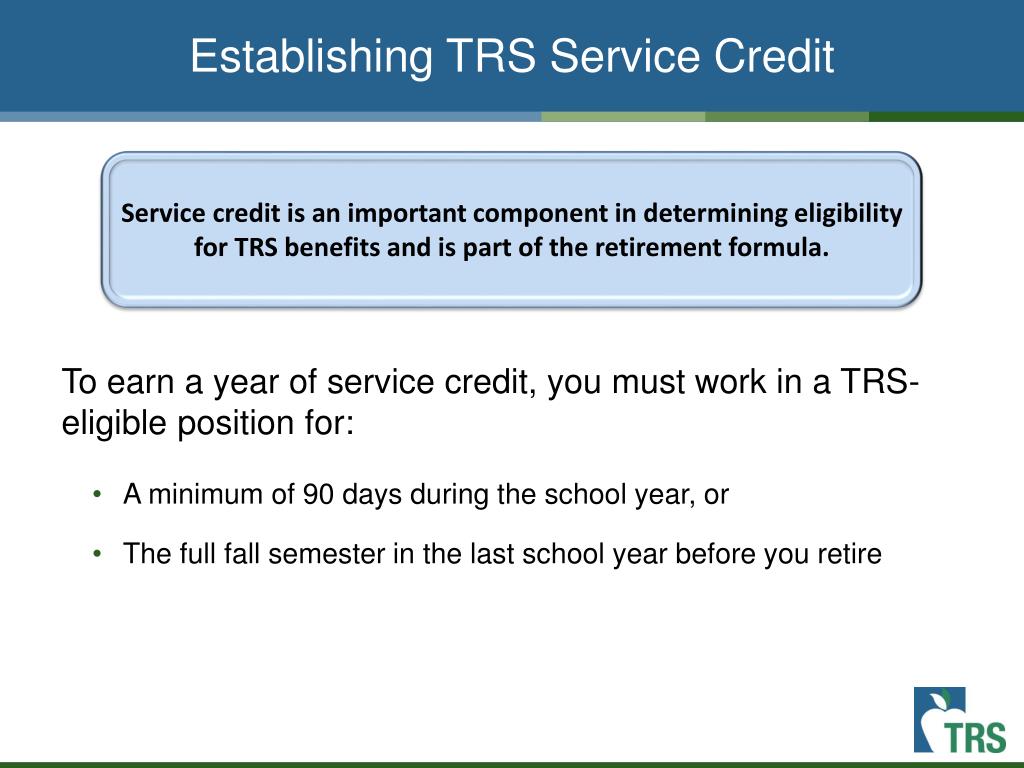

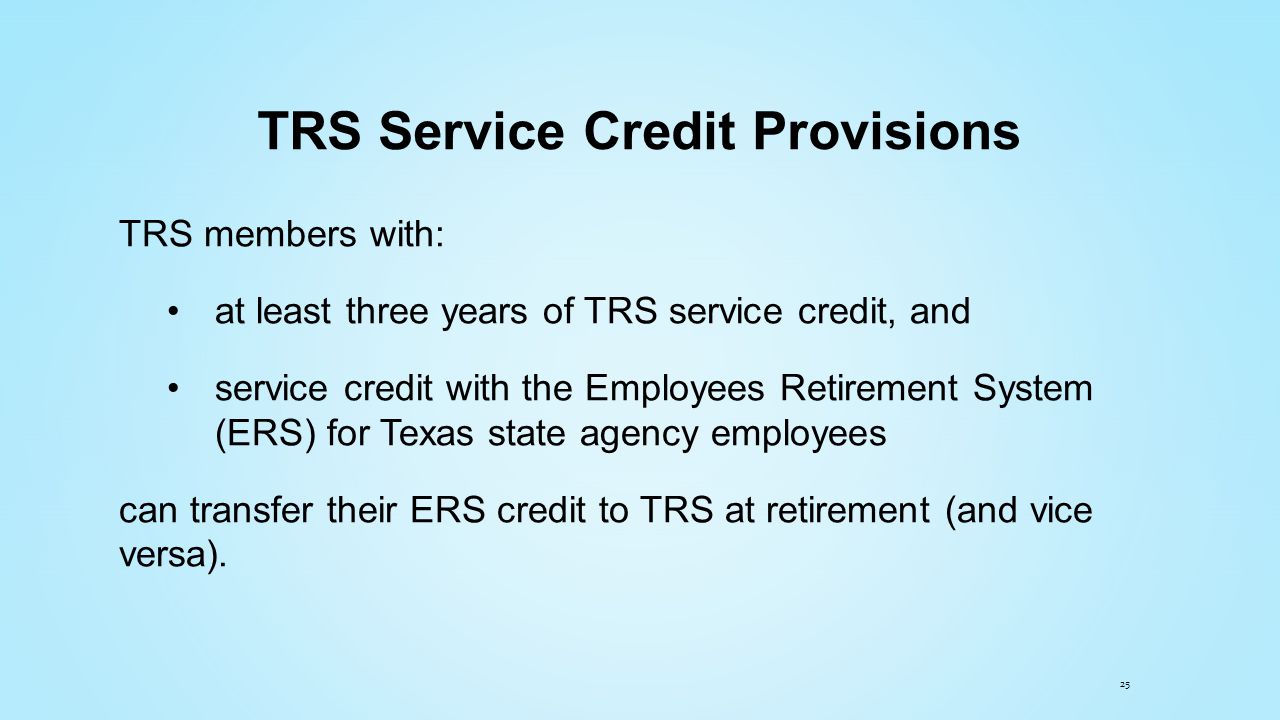

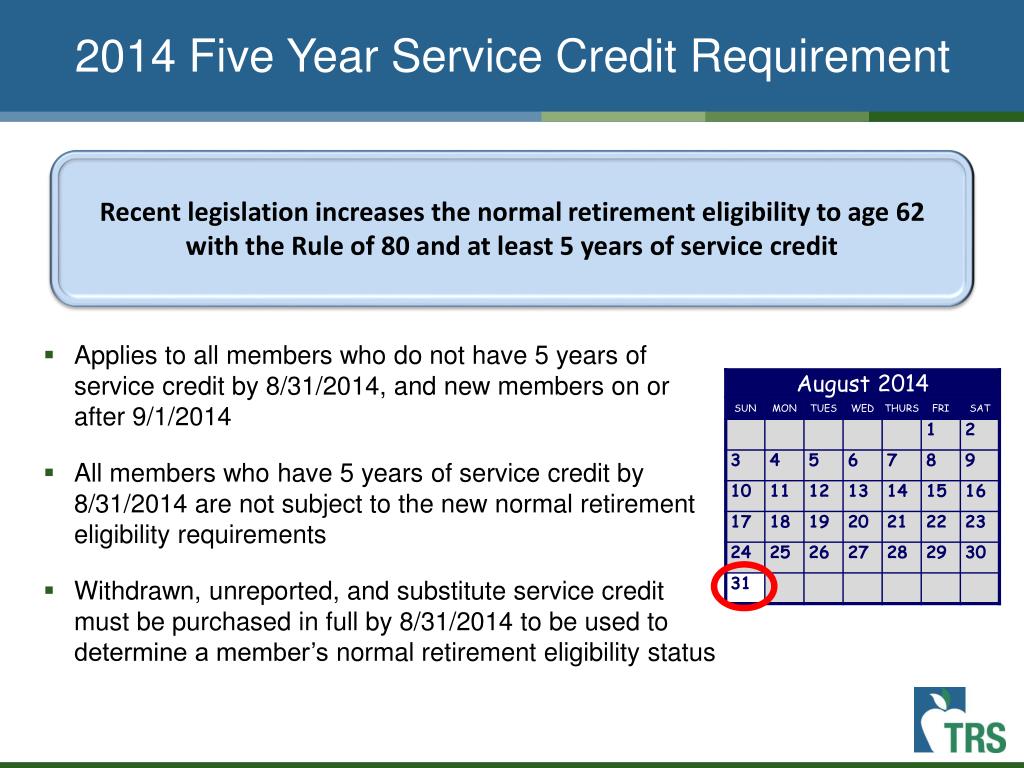

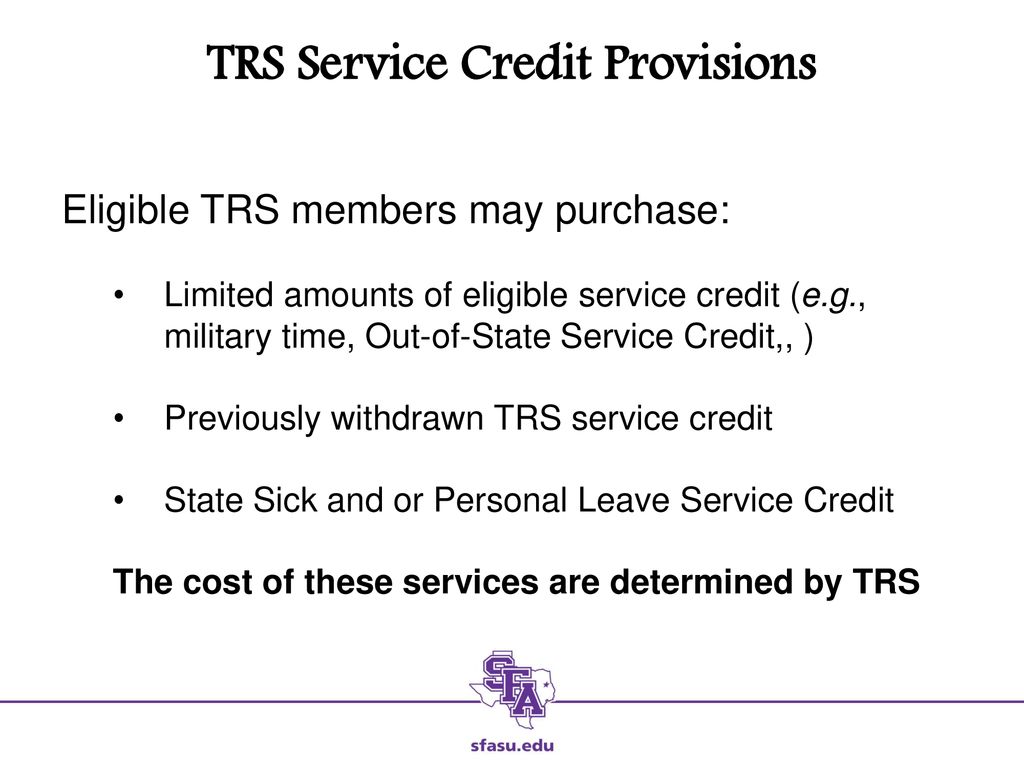

Trs Service Credit Brochure - Withdrawn service credit occurs if you. The service credit can be used. “days paid” include any weekday (monday through friday) for which payment is made to you for: Since 1959, trs grants a full year of service credit to any member who is employed and receives creditable earnings for 170 days during any school year upon certification of the employer. Trs service credit is an important part of determining and calculating eligibility for view additional information in the trs service credit brochure available at trs.texas.gov. You have the option to purchase special service credit (if you would like additional information on special service credit purchase, visit the teacher retirement system website. There are three basic ways to make payment for service credit purchases: Individual publications are often directed at a specific group of members (i.e., tier i and ii members, tier. • school year is july 1 through june 30. Service credit the chart below indicates the three types of service that can comprise your total years of creditable service upon retirement. Please see the table on page 3 for a summary of service credit and deficits for tiers iii and iv members. Go to this page to learn more about service credits An exception is made for individuals in their final year before retirement;. Purchasing service can assist you in attaining. Member earns 1 full year of trs service credit. Since 1959, trs grants a full year of service credit to any member who is employed and receives creditable earnings for 170 days during any school year upon certification of the employer. This brochure summarizes the different. • school year is july 1 through june 30. Service credit determines your eligibility for a retirement annuity. Teacher retirement system of texas 5 withdrawn service credit overview and eligibility:. A member should have any optional service recorded with trs as soon as possible. You can also find additional information about tiers iii and iv membership by. Please see the table on page 3 for a summary of service credit and deficits for tiers iii and iv members. Member earns 1 full year of trs service credit. • less than. Individual publications are often directed at a specific group of members (i.e., tier i and ii members, tier. • less than 170 days. There are three basic ways to make payment for service credit purchases: Purchasing service can assist you in attaining. Service credit the chart below indicates the three types of service that can comprise your total years of. Teacher retirement system of texas 5 withdrawn service credit overview and eligibility:. There are three basic ways to make payment for service credit purchases: In all cases, you must submit the. Purchase service credit when eligible to do so. This brochure summarizes the different. Since 1959, trs grants a full year of service credit to any member who is employed and receives creditable earnings for 170 days during any school year upon certification of the employer. Trs service credit is an important part of determining and calculating eligibility for view additional information in the trs service credit brochure available at trs.texas.gov. Please refer to. Please see the table on page 3 for a summary of service credit and deficits for tiers iii and iv members. • school year is july 1 through june 30. • less than 170 days. A member should have any optional service recorded with trs as soon as possible. Trs employer and who return to covered employment within the time. An employee who is not retiring must work at least 90 days during the school year to receive a year of service credit. Service credit calculation • 170 or more days worked in the school year: An exception is made for individuals in their final year before retirement;. A member should have any optional service recorded with trs as soon. An exception is made for individuals in their final year before retirement;. Purchasing service can assist you in attaining. You have the option to purchase special service credit (if you would like additional information on special service credit purchase, visit the teacher retirement system website. Please see the table on page 3 for a summary of service credit and deficits. An employee who is not retiring must work at least 90 days during the school year to receive a year of service credit. “days paid” include any weekday (monday through friday) for which payment is made to you for: Purchase service credit when eligible to do so. This brochure summarizes the different. Service credit determines your eligibility for a retirement. • less than 170 days. Service credit determines your eligibility for a retirement annuity. Please refer to the trs service credit brochure for complete descriptions of the types of service that may be purchased and eligibility requirements. There are three basic ways to make payment for service credit purchases: An exception is made for individuals in their final year before. Teacher retirement system of texas 5 withdrawn service credit overview and eligibility:. Trs employer and who return to covered employment within the time period required under the userra federal law may be eligible to purchase up to 5 years of military service credit for. Please see the table on page 3 for a summary of service credit and deficits for. You have the option to purchase special service credit (if you would like additional information on special service credit purchase, visit the teacher retirement system website. The service credit can be used. Service credit determines your eligibility for a retirement annuity. The deadline for state sick and/or personal leave is described later in this brochure. Trs service credit is an important part of determining and calculating eligibility for view additional information in the trs service credit brochure available at trs.texas.gov. You can also find additional information about tiers iii and iv membership by. This brochure summarizes the different. Please see the table on page 3 for a summary of service credit and deficits for tiers iii and iv members. Since 1959, trs grants a full year of service credit to any member who is employed and receives creditable earnings for 170 days during any school year upon certification of the employer. Go to this page to learn more about service credits In all cases, you must submit the. • school year is july 1 through june 30. There are three basic ways to make payment for service credit purchases: Service credit the chart below indicates the three types of service that can comprise your total years of creditable service upon retirement. “days paid” include any weekday (monday through friday) for which payment is made to you for: An employee who is not retiring must work at least 90 days during the school year to receive a year of service credit.543 to Retirement. ppt download

PPT Overview of TRS 20132014 PowerPoint Presentation, free download

TRS 30Day Credit Account TRS SERVICE

543 to Retirement. ppt download

TRS 101 Mary Ann Wood Human Resource Director August, ppt download

Fillable Online Service Credit Brochure Texas Fax Email Print pdfFiller

Overview of TRS and ORP for Employees who are Eligible to Elect ORP

Service Credit Brochure TRS Texas.gov Doc Template pdfFiller

PPT Overview of TRS 20132014 PowerPoint Presentation, free download

543 to Retirement. ppt download

Trs Employer And Who Return To Covered Employment Within The Time Period Required Under The Userra Federal Law May Be Eligible To Purchase Up To 5 Years Of Military Service Credit For.

An Exception Is Made For Individuals In Their Final Year Before Retirement;.

Purchase Service Credit When Eligible To Do So.

• Less Than 170 Days.

Related Post: